Import Unit Loader

Navigate:  Personal

Property Appraisal > Batch Processes

> Import Unit Loader

Personal

Property Appraisal > Batch Processes

> Import Unit Loader

Description

NOTE: Your jurisdiction may not use this task.

Use this task to import data files on the Schedule Import Unit Loader screen for:

Jurisidiction Specific Information

Jurisidiction Specific Information

Riverside, California

-

The account export .xml file includes lease information, multiple new locations for the same assessee, and related entities.

-

Export the file using the Account Export batch process.

-

Then, Import the .xml file using the Import Unit Loader

-

Process the imported account(s) via Batch Processes > Interface Queue Processors.

- The Ordered Command for this process uses a configuration script from your Aumentum Implementation team.

Steps

Depending on the type of data imported, such as vehicle registration and watercraft, after processing the import in the interface queue processor, the data is displayed in the Discovery Worklist. Certain data can be edited in the worklist.

-

Select the type of import and schedule it on the Schedule Import Unit Loader screen. The imported data is sent to the interface queue processor.

-

Use the Schedule Interface Queue Processor screen to process the imported data.

-

For certain imported files, such as for vehicle registration and watercraft data, the import record can be selected on the Manage Discovery Worklist screen where it is displayed and edited, if required.

Aircraft Import

This import is directly downloaded from the FAA (Federal Aviation Administration) site, which contains a list of aircraft and owners. Once imported, the file is sent to the interface queue processor for scheduling and processing.

The processor looks for aircraft tail number and owner match and, for any:

-

Matches, creates a new personal property record, available from the Maintain PPA Accounts screen (Personal Property Appraisal > Accounts) and adds the assets to the account, which are available for review and maintenance on the Maintain Assets

-

Mismatches or missing owners, sends the records to Discovery for manual processing on the Manage Discovery Worklist screen.

The processor looks at aircraft weight and sends that information to the Weight field as an asset attribute on the Maintain Assets screen.

NOTE: Attributes are maintained on the Maintain Attributes screen (Personal Property Appraisal > Setup > Attributes > Maintain Attributes).

Steps

-

Select the type of import and schedule it on the Schedule Import Unit Loader screen. The imported data is sent to the interface queue processor for processing.

-

Use the Schedule Interface Queue Processor screen to process the imported data.

-

For mismatched aircraft tail number and owner, select the imported record on the Manage Discovery Worklist screen for manual editing and processing.

DMV Import

The DMV Asset File contains an inventory of motor vehicle assets. When the file is processed, new legal parties, personal property accounts, and assets may be added to Aumentum. In addition, existing accounts and assets may be updated. Originally, the DMV Import was 4 characters in length for the car make, while the make in the Department of Revenue (DOR) tables being imported was not always consistent in naming conventions (e.g., HOND versus HONDA). The DOR Import now sets the full name of the make on the asset record to match the DOR import so that mapping is to the correct DMV makes.

DMV records are imported using the Import Unit Loader > Schedule Import Unit Loader task. You can also transmit records to the DMV using the DMV Transmittal task, available via Personal Property Appraisal > Batch Processes > DMV Transmittal > Schedule DMV Transmittal.

New Legal Party

A new legal party is added to Aumentum when a legal party search using Owner Name and Owner Address returns no results or if a multiple legal party match is found. The legal party type is set to Organization if the incoming Business Indicator equals Y (yes). If it equals N (no), the legal party type is Individual.

When you import a DMV file, if an owner was removed, then the item is sent to Discovery so that you can verify and remove the owner.

Addresses

A new mailing address is added to Aumentum when a search using Owner Address, City, and Zip Code returns no results.

Also, a second mailing address for the owner is created when the "Special Mail" address in the import file (columns 201-288) contain data. The second address is added with a correspondence type of "DMV Address."

Existing Asset - New Tax Year

If the search by VIN finds an existing asset, but not for the tax year being imported, the asset is imported and an asset cycle records is created for the import tax year.

Existing Asset - Reactivate

If the search by VIN finds an existing asset but the associated revenue object is inactive, the asset is imported and the revenue object is activated. A message displays on the Confirmation Detail report indicating the revenue object was reactivated.

New Asset and Account

A new personal property account and asset are added to Aumentum when a search by Vehicle Identification Number (VIN) finds no existing asset for any cycle.

A filing revenue object and its associated personal property account are created.

-

Lookup class code based on vehicle type and generate revenue object’s PIN, AIN and description based on class code.

-

Set Tax Authority Group (TAG) as follows:

-

When the street name of the owner address in the import record matches the street name of an address in the SitusAddr table, the TAG is assigned based on the TAG for the revenue object with the matching situs address.

-

When the street name of the owner address in the import record does not match a street in the SitusAddr table, the TAG is set to "Unassigned TAG" and an entry is made in the Confirmation Detail Report.

-

Create situs address for revenue object based on owner address.

-

Create property account identifiers based on Municipality and School District.

-

Create property account attribute DMVOwnerName.

Create the asset and asset cycle record for the imported tax year:

-

From import file, setup the following asset fields: Fuel Type, Make, Model, Year, Body Type, Weight, and Plate Expiration.

-

Add the following asset identifiers: Secondary Owner, Plate Number, Plate Year, Validation Number, VIN.

-

Add the following asset attributes: Business (y/n), Lease (y/n), Dealer Sale (y/n), Insurance Required, Fee Collected, Purchase Date, Renewal Fee, Expiration Month, Expiration Year, VCS Number and Plate Class.

-

Set the Acquired Date to the imported Issue Date.

-

The asset's use is set to "Exempt" when the record type equals "1" and the Plate Class equals one of the following: ’r;XA’, ’r;XP’, ’r;XX’, ’r;XZ’, ’r;PT’, ’r;CG’, ’r;RG’, ’r;SG’, ’r;MG’, ’r;DV’, ’r;PW’, ’r;MH’. Also, the attribute PlateClass is set to the appropriate plate class.

-

The asset's use is set to "Business Use" when the Business Indicator imported from the file equals 'Y' .

-

The asset's use is set to "Personal Use" when the Business Indicator imported from the file equals 'N' .

-

Assign the Asset Category based on the vehicle type as follows:

|

Vehicle Type |

Asset Category |

|

0 |

NoCharge |

|

1 |

Auto |

|

2 |

ComnCarrier |

|

3 |

Bus |

|

4 |

NonVehicle |

|

5 |

TRK |

|

5 & GVW > 26001 |

TRKHVY |

|

5 & GVW between 11000 and 26000 and empty weight > 90000 |

TRKMED |

|

6 |

UT |

|

7 |

MC |

|

8 |

LowSpeedVehicle |

-

New Plate 120 Day Due. The asset's Established Date is set to the Issue Date and a 120 Day Due flag is added to the revenue object when the incoming record type is "2" and the Type Tag is "1" and the Dealer Sale = 'Y' or Dealer Sale = 'N'.

-

Renewal from Another County. The asset's Moved In Date and Established Date are set to the Issue Date the record type is "2" and the Type Tag is "3".

-

Plate Transfer Renewal Not Due - Owner Match. The asset's Moved In Date and Established Date are set to the Issue Date when the record type is "2," the Type Tag is "4," and there is an existing asset matching on Plate Number and Owner.

-

Plate Transfer - Trade In, Owner Match. The asset's Moved In Date and Established Date are set to the Issue Date when the record type is 2, the Type Tag is 5, there is an existing asset matching on Plate Number and Owner, and the Owner of the existing asset is the same as the owner of the asset being imported.

-

When the import record's RG-Fee-Collected value is "Y," create the "fee needs to be billed" flag on the asset's account if it does not already exist and remove any other bill registration fee flags from the account.

-

When the import record's RG-Fee-Collected value "N," create the "fee is not to be billed" flag on the asset's account if it does not already exist and remove any other bill registration fee flags from the account.

-

When the import record's RG-Fee-Collected value "D," create the "fee is discounted" flag on the asset's account if it does not already exist and remove any other bill registration fee flags from the account.

-

When the import record's Insurance Required flag (column 194) is set to "Y," the asset's DMV Insurance (DMVINS) asset attribute is selected (the checkbox contain a check mark). If the Insurance Required flag is "N," the DMVINS asset attribute is not selected (blank). The asset attribute can be viewed and maintained on the Maintain Assets page.

Department of Natural Resources Import

Currently, this task applies to the State of Georgia (USA) only. Appraisers use the Import Unit Loader to import an Excel file of watercraft registrations received from the state DNR. The outcome of this process is a list of new assets in Discovery (Personal Property Appraisal > Discovery > Manage Discovery Worklist) that are not accounted for in PPA and a list of existing assets that have an ownership change, including:

-

Column Title

-

Certificate Number

-

Class

-

Owner Type

-

Last Name

-

First Name

-

Middle Int

-

Jr_Sr

-

Street

-

City

-

State

-

Zip Code

-

County Code

-

Processed Date

-

Expiration Date

-

HIN

-

Year Built

-

Manufacturer

-

Lenth_Feet

-

Length_Inches

-

Boat Type

-

Hull Material

-

Fuel

-

Marine Toilet

-

Propulsion

-

Use

-

Stolen

-

Transaction Type

-

CG Doc Number

To import the DNR file:

-

Select the Georgia DNR Interface Import type on the Schedule Import Unit Loader screen.

-

Enter the Input File Name after the shared folder location (ex: \\Web9004\Gwinnett_9_0_04_Files\PPA\DNR_2013.xlsx). Set the Schedule date and click Finish to start the batch process.

-

To import unprocessed DRN Import Units, go to Personal Property Appraisal > Batch Processes > Interface Queue Processors > Schedule Interface Queue Processor.

-

Enter the tax year you want to process and select the GA.DNR Import type.

-

Enter the Effective date of 01/01/xxxx, where xxxx is the tax year you are processing.

-

Set the date and time to schedule the batch process and click Finish. Import Units are sent to Discovery when there is no match on Registration Number and/or Owner Name.

-

View these Import Units via Personal Property Appraisal > Discovery > Manage Discovery Worklist.

-

Select the GA.DNR queue.

-

Select a result and click Review. Update the information as needed.

-

Click Update, then Save.

Setup

Navigate to your shared folder location for Personal Property Appraisal files (ex: \\Web9004\Gwinnett_9_0_04_Files\PPA\) and copy the DNR excel file to the shared folder location.

Personal Mobile Home Characteristic Data

Personal mobile home characteristics are valued in Orion and imported from Orion to Aumentum as a batch process. These are loaded into a selected interface queue if the input file type is recognized by Aumentum. The Schedule Import Unit Loader screen lists interfaces only when an interface converter name is defined.

NOTE: It is also possible to feed XML data directly into the queue using a stored procedure. Contact the Aumentum Support team for more information.

The appraised value in the import record is placed into Value Basis, and all mobile home characteristics in the import record overwrite the same characteristics in Aumentum PPA, including:

-

Mobile Home Style (Single or Doublewide)

-

Year of Home

-

Width

-

Length

-

Quality/Grade

-

Home Condition

-

Make

-

Model

-

Serial Number

-

Lot #

-

Tagalong Style (Single or Doublewide)

-

Tagalong Width

-

Tagalong Length

-

Component Code

-

Units

The appraised value in the import record is placed into Value Basis, and all mobile home characteristics in the import record overwrite the same characteristics in Aumentum PPA, including:

-

Mobile Home Style (Single or Doublewide)

-

Year of Home

-

Width

-

Length

-

Quality/Grade

-

Home Condition

-

Make

The ability to view the values and process them, including enter an override value and a reason, is available on the Manage Discovery Worklist screen. Certified values are sent to Assessment Administration.

NOTE: An error is written to the Exception Report for any of the following conditions:

-

There is no match on the PIN (the account is missing in Aumentum PPA),

-

The account is found but no match exists for the serial number (potential owner change).

Vehicle Registration Data

Registration data is received via the ATCI application. The Vehicle Information Processing System (VIPS) generates a daily transaction file, which includes mobile home and vehicle registration information. The VIPS transaction file is captured by the ATCI application. The import record is in XML format

The types of assets imported are included for the following vehicles:

-

Mobile Homes

-

Non-highway vehicles

-

Trailers

-

Mopeds

-

All Terrain

-

16/20M Trucks

-

>20M Trucks

-

Motor Home

-

Motorized Bicycle

The data imported includes:

-

Transaction Date (Registration Date)

-

Plate Number

-

Decal Number

-

Owner Name

-

Owner Address

-

Purchase Date

-

Moved In Date

-

Year

-

Make

-

Model

-

VIN/Serial

-

Gross Weight

-

Registration Expiration Date

-

Gross Sales Price

-

Purchase Price

-

Vehicle Class Code – This is not the appraiser class code for 16/20M; this contains values such as 910, 920, 930 and 940 and is display only.

-

Vehicle Truck Class – display only in Discovery Worklist.

-

Vehicle Type – display only; example value is HT.

Watercraft Data (Boat, Motor, or Trailer)

NOTE: This applies to Kansas only.

Watercraft asset data is received from the DNR (Fish & Game) four times a year in the form of a text file. Legal party, personal property account, and personal property asset data is not added or updated in Aumentum as a result of the import process.

Aumentum PPA compares the KA number (a number assigned by the Fish & Game) and Owner Name on the import record to the Aumentum database where it is processed in the interface queue processor to determine if there is a match. If an exact match is found, the import record is skipped. If a match is not found, the import record is written to the Discovery Worklist.

NOTE: The KA number is not displayed/printed.

Examples of acquisition/disposed dates

Examples of acquisition/disposed dates

NOTE The acquired date for a truck or boat purchased after August 31 is January 1 of the following year.

Example #1: June 1, 2009 (using activity date, which is mm/yyyy), John sells boat to Dave.

-

David's acquired date is June 1, 2009.

-

John's disposed date is May 31, 2009.

Example #2: September 15, 2009, Paul sells boat to Mary.

-

Mary's acquired date is January 1, 2010.

-

Paul's disposed date is December 31, 2009.

Imports occur as follows:

-

January – Contains all watercraft registrations from the previous year.

-

April – Contains watercraft registrations for January, February, and March of the current year.

-

July – Contains watercraft registrations for April, May, and June of the current year.

-

October – Contains watercraft registrations for July, August, and September of the current year.

Data imported includes:

-

Owner Name – The owner’s name (First MI Last) – no commas. MI not always present.

-

Address – The owner’s street address.

-

City – The owner’s city.

-

State – The owner’s state; should be KS.

-

Zip – The owner’s zip; should start with 67.

-

Birth date – mm/dd/yyyy – The county wants to keep this information even though their current system does not store it. They want to start populating this data in Aumentum.

-

Boat Registration Number – This is the state-assigned KA#. All import records should have this number. Currently, the county stores the KA# in the VIN field.

-

Expiration Date – This is when the KA# expires. Owners register watercraft every 3 years in Kansas.

-

Year Built – YYYY. This is the year the watercraft was built.

-

Length – This is the length of the watercraft.

-

Make – This is the make of the watercraft.

-

Hull ID – If available, this is the Hull ID. Their current system does not store this data, but they want to in Aumentum. The import record will not always have a Hull ID.

-

Toilet (TO) – Y/N – Indicates whether or not the watercraft has a toilet. The county does not care.

-

Hull Material (HM) – Indicates what material the watercraft is made of, such as fiberglass or aluminum. The county does not care.

-

Propulsion (PR) – Specifies the watercraft’s propulsion, such as SB for Sail Boat and RO for Row Boat.

-

Fuel (FU) – Specifies type of fuel watercraft uses.

-

Use (U) – Specifies Personal (P) or Business (B) use. The import records should all be personal.

-

HP – This is the motor’s horsepower.

-

YR – This is the motor’s year.

-

Len – This is the length of the trailer.

-

YR – This is the year of the trailer.

-

Activity Date – This is the date the owner registered the watercraft with the Kansas Fish and Game. For the January file, Marc only looks at October, November, and December registrations.

Vessels

A DMV import for vessels called California DMV vessels interface is available for importing vessel information. Imports occur monthly in California.

The Interface Queue Processor (PPA > Batch Process > Interface Queue Processors) Import Type of CA_DMV_Vessels is used to process the records once imported into Aumentum. Data is imported to XML format. Rules are verified during the import for:

-

Asset inventory number

-

Owner name and address

-

Any other applicable data that must match based on business rules.

No changes in data are made for exact records matches and new record creation for these records is skipped. If there is a records match but data is different, then an update in Aumentum is required to the record. If no match exists, a record is created in Aumentum. Any purge records are inactivated.

Data created for new records and required for imported records includes:

-

Revenue Object

-

Description Header

-

Free Form Description

-

Legal Party

-

Legal Party Role

-

Account

-

Situs Address

-

Situs Address Role

-

Communication

-

Communication Role

-

Personal Account

-

Personal Account Cycle

-

Asset Type

-

Asset Role

-

Asset Role Cycle

-

Asset Registration

After completion all items are set to either Complete or Error. The DMV Import in the Discovery Queue (Personal Property Appraisal > Discovery) is called CA_DMV_Vessels and the Discovery Queue is updated with any exceptions. The exception reason (e.g., Vessel Characteristics Differ, DMV Vessel New Address, DMV Vessel New Owner, etc.) is shown in the queue.

The Confirmation Detail Report lists import activity and results. The report includes the:

-

Total Created Accounts

-

Total Ownership Changes

-

Total Mailing Address Changes

-

Total Asset Data changes

-

Total Situs Address Changes

ATCi

Some jurisdictions have a state application vehicle processing system that generates a daily transaction file that is captured by a separate application called ATCi. Some assets, such as vehicles and motor homes, are taxed when tagged; hence no tax bill is required. However, these assets must still be placed on the tax roll so that a tax bill is generated in the future.

The appraiser uses the ATCi Import data to discover assets that property owners have registered but not reported to the Appraiser Office.

ATCi runs a query against the VIPS transaction file to filter the transactions that the appraiser needs to review. ATCi formats the transactions into a standard PPA XML format that calls Aumentum's stored procedure so that the import units are added to the Discovery queue. Aumentum processes the XML import units in the Discovery queue, and:

-

If an import unit matches a Aumentum PPA account on Owner and VIN, the import record is skipped

-

If a match on Owner and VIN is not made, the import unit is written to the Aumentum PPA Discovery Worklist

NOTE: For 16/20M trucks discovered through the ATCi import process, the appraiser also has the ability to assign a State Value Code (SVC) to these assets in the Discovery Worklist (when automated) as well as on the Maintain Assets screen (for manual update).

Oil & Gas Customers

The ability to import values for oil and gas accounts for royalty interests is also available for certain jurisdictions that use a separate application, for example, OG, which values the accounts separately from Aumentum. The Discovery process is not used for this type of import but instead, the import directly updates Aumentum asset data. Data is imported only into Aumentum, not exported from Aumentum. The import does not create legal parties, personal property accounts, or assets, so it is the jurisdiction's responsibility to ensure that a one-to-one relationship exists between the accounts and assets that are in Aumentum and in the separate application.

Accounts are matched between the imported OG data and Aumentum data using PIN and Tax year. Any units not matching PIN and Tax Year are written as exceptions to the Confirmation Detail batch report. They are not written to the Discovery Queue. Asset values and attributes within Aumentum are replaced with the imported data and places the asset’s value into Value Basis. The oil and gas asset categories are configured to value at 100% of Value Basis

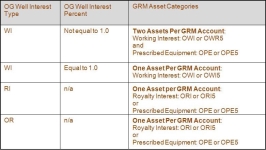

Here is an example of an OG type table and how Aumentum manages the assets.

eGov Electronic Filings

You can import, match, and compare eGov electronic filing data to existing current Aumentum data. This process also supports imports such as DNR and ATCi imports.

eGov sends account and asset data to Personal Property Appraisal when a property owner submits a yearly filing. This submittal is via an XML file or directly into the eGov queue using the PPA API.

When XML files are received, the Import Unit Loader batch task is run first. The Interface Queue Processor batch process is then run to check in the accounts and send them to Discovery where they are reviewed.

California

-

For electronic filing customers, after running the Import Unit Loader the system saves all entries and changes the Statement Status on the particular account(s) to E-file Incomplete so that processing must occur in the Interface Queue Processor before the electronic filing is processed and complete.

Mineral Import

Certain jurisdictions consider mineral interests in minerals that may exist below the surface of property to be personal property. The rights to these minerals, like real property, can be divided and classified according to the mineral.

Mineral data is imported using the Import Unit Loader task. When finished importing:

-

Click Batch Processes > Interface Queue Processors, select and run the Mineral Import process for the same tax year as your import.

-

Once the personal property appraisal account(s) is created or updated from the processing, go to Personal Property Appraisal > Accounts and search for the newly created account by AIN or PIN to advance to the Maintain PPA Accounts screen.

-

On the Maintain PPA Accounts screen, optionally click Common Actions > Event History to open the Info Center Event History screen to see the event created for the new account.

NOTE: You can also view mineral appraisal information via Info Center > Mineral Appraisal Information, if applicable to your jurisdiction.